Background

This study was for FCAT Client EXPRESS in April 2019.

The client is a large and well established mutual fund family that uses Fidelity.com as a selling platform. Their user research team requested a deep-dive study aimed at uncovering the motivators, decision-drivers, and process for individual retail investors purchasing mutual funds. Results would be used to help the fund family create a purchase decision tree and develop marketing initiatives for investors using Fidelity.com to purchase their mutual funds.

We all agreed that interviews and a set of journey maps was the way to go.

Process

The fund family wanted to hear from 24 mutual-fund customers from three age ranges, and although the plan was to segment the journey maps based on the age groupings, there was agreement that if the data pointed to different groupings, we would adjust accordingly. An external vendor would recruit using a Fidelity customer list.

The client wanted about half of the participants to own one of their funds, but Fidelity’s standard customer lists would not include this information. The solution was to work with Fidelity’s marketing insights group to generate a unique customer list with this information. The process took a couple extra weeks, but it was necessary to recruit the right participants.

I collaborated with the client on the moderator’s guide, drafted a branded journey map in Sketch, ran a successful pilot, and set up Reframer for capturing notes.

I used the question numbers from the mod guide as tags for orientation during note-taking & analysis.

We ended up running 22 sessions over the course of two weeks, and I remotely moderated about 20 of them. We used Zoom for video-conferencing and Camtasia to capture video.

The sessions were a great success, with lots of interesting and thoughtful participants. But the greatest challenge was still ahead: analyzing 22 hours of qualitative data, segmenting the participants into groups, and building the journey maps.

It was clear that our data were only vaguely aligned with the age segments we started with, so I started fresh using the notes my teammate captured in Reframer. I created matrices in Mural.ly that reflected some of the attributes and processes we captured in the sessions, then plotted participants in the matrices.

The client liked the matrix approach, but we were still struggling to define the segments. The participants just weren’t splitting into defined groups based on our notes or memories. So the client requested that we pivot: instead of detailed journey maps, they instead wanted to see a detailed report of findings, insights, and quotations from the interviews we conducted, plus notional journey maps if time allowed.

Yikes!

This change in direction made good sense, but all of the notes had been written with the journey-map deliverables in mind. We had captured very few quotations, and commentary that would not be relevant to journey maps was frequently omitted from the record.

With four days until the read-out, I started over from scratch. First, I created a top-of-mind list of findings in Excel and assigned each participant a column. I then watched all 22 hours of videos, taking copious notes and capturing many quotations. I updated each finding with participant counts and the P #s, then created a color-coding system to try to spot trends in the data.

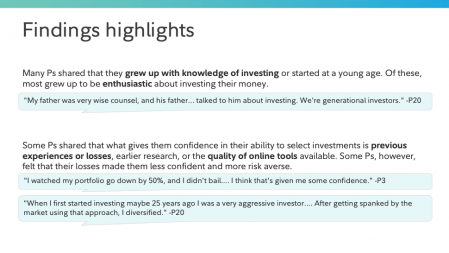

Results

Though the pivot resulted in several late nights, it enabled me to confidently deliver a solid findings report. And despite the initial difficulty, the detailed analysis and color-coding exercise ultimately did lead to a set of notional segments and journey maps, all of which I was able to deliver on time.